The crash of 1929 video questions answers – Delving into the Crash of 1929, this comprehensive guide provides insightful video questions and answers that unravel the intricate tapestry of this pivotal event. By examining its historical significance, contributing factors, and lasting implications, we gain invaluable lessons for navigating modern financial landscapes.

The ensuing paragraphs meticulously explore the economic and social conditions that culminated in the crash, analyze the government policies and psychological factors that exacerbated the crisis, and delve into the devastating consequences that reverberated throughout the nation.

Historical Overview of the Crash of 1929

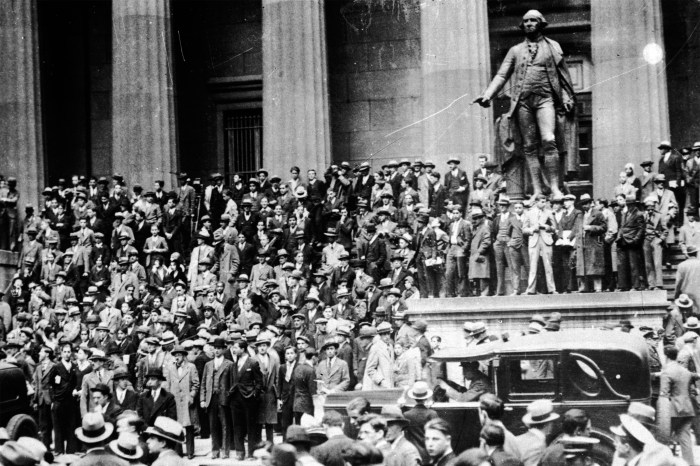

The Crash of 1929, also known as Black Tuesday, was a pivotal event in American history that had a profound impact on the global economy. This section provides a comprehensive overview of the historical context, triggers, and immediate consequences of the crash.

Economic and Social Conditions Leading Up to the Crash

The years leading up to the Crash of 1929 were characterized by unprecedented economic growth and speculation. The stock market soared to record highs, fueled by a surge in consumer spending and unregulated lending practices. Overconfidence and a belief in the endless growth of the market permeated the public consciousness.

Events Triggering the Crash

On October 29, 1929, the stock market experienced a sharp decline, triggering a chain reaction of panic selling. The immediate cause of the crash is still debated, but several factors contributed, including a decline in business profits, overextended credit, and a loss of confidence among investors.

Immediate Impact of the Crash

The crash had an immediate and devastating impact on the stock market. The Dow Jones Industrial Average plummeted by nearly 12% in a single day, wiping out billions of dollars in wealth. The economic fallout extended beyond the financial sector, leading to widespread business failures and job losses.

Causes and Contributing Factors

The Crash of 1929 was a complex event with multiple underlying causes. This section analyzes the economic, government, and social factors that contributed to the crisis.

Underlying Economic Factors

- Overspeculation and unregulated lending

- Declining business profits

- Weak banking system

Government Policies

- Federal Reserve’s monetary policies

- Lack of regulation in the financial industry

Social and Psychological Factors

- Public overconfidence in the stock market

- Desire for quick profits

- Lack of financial literacy

Consequences and Long-Term Effects

The Crash of 1929 had far-reaching consequences for the U.S. economy and society. This section examines the immediate and long-term impact of the crash.

Economic Impact

- Job losses and business failures

- Decline in consumer spending

- Contraction of the economy

Social and Psychological Impact

- Widespread poverty and despair

- Loss of faith in the financial system

- Social unrest

Long-Term Consequences

- Great Depression

- New Deal policies

- Increased regulation of the financial industry

Lessons Learned and Modern Implications: The Crash Of 1929 Video Questions Answers

The Crash of 1929 serves as a cautionary tale about the dangers of financial instability. This section discusses the lessons learned from the crash and their relevance to modern financial markets.

Lessons Learned

- Importance of financial regulation

- Need for a stable banking system

- Dangers of overspeculation

Modern Implications, The crash of 1929 video questions answers

The lessons learned from the Crash of 1929 have influenced modern financial regulations and policies. Measures have been put in place to prevent a similar crisis from occurring, including:

- Increased regulation of the financial industry

- Creation of the Federal Deposit Insurance Corporation (FDIC)

- Establishment of the Securities and Exchange Commission (SEC)

Understanding the Crash of 1929 is crucial for policymakers and financial professionals to ensure the stability of modern financial markets.

FAQ Compilation

What were the key economic factors that contributed to the Crash of 1929?

Overspeculation, unregulated lending, and a lack of government oversight played significant roles in creating the economic bubble that ultimately burst.

How did the government’s monetary policies contribute to the crisis?

The Federal Reserve’s decision to raise interest rates in 1928 and 1929 exacerbated the stock market decline and made it more difficult for businesses to borrow money.

What were the social and psychological factors that fueled the speculative frenzy?

Public overconfidence in the stock market, fueled by a belief that stock prices would continue to rise indefinitely, contributed to the excessive risk-taking that characterized the period leading up to the crash.